The annual NewsCut tradition — our 10th and last — is underway with the arrival of your property tax statement, that completely indecipherable calculation that leads to the bottom line.

Times are good in the economy, they say, so almost every unit of government took the opportunity to dig deep after — allegedly — years of what they considered austerity.

The Trump tax break to (mostly) the wealthy has eliminated the property tax deduction in favor of a higher standard deduction (offset somewhat by the loss of exemption, but that’s a different topic), which makes things sting a little more this year.

Let’s get to it:

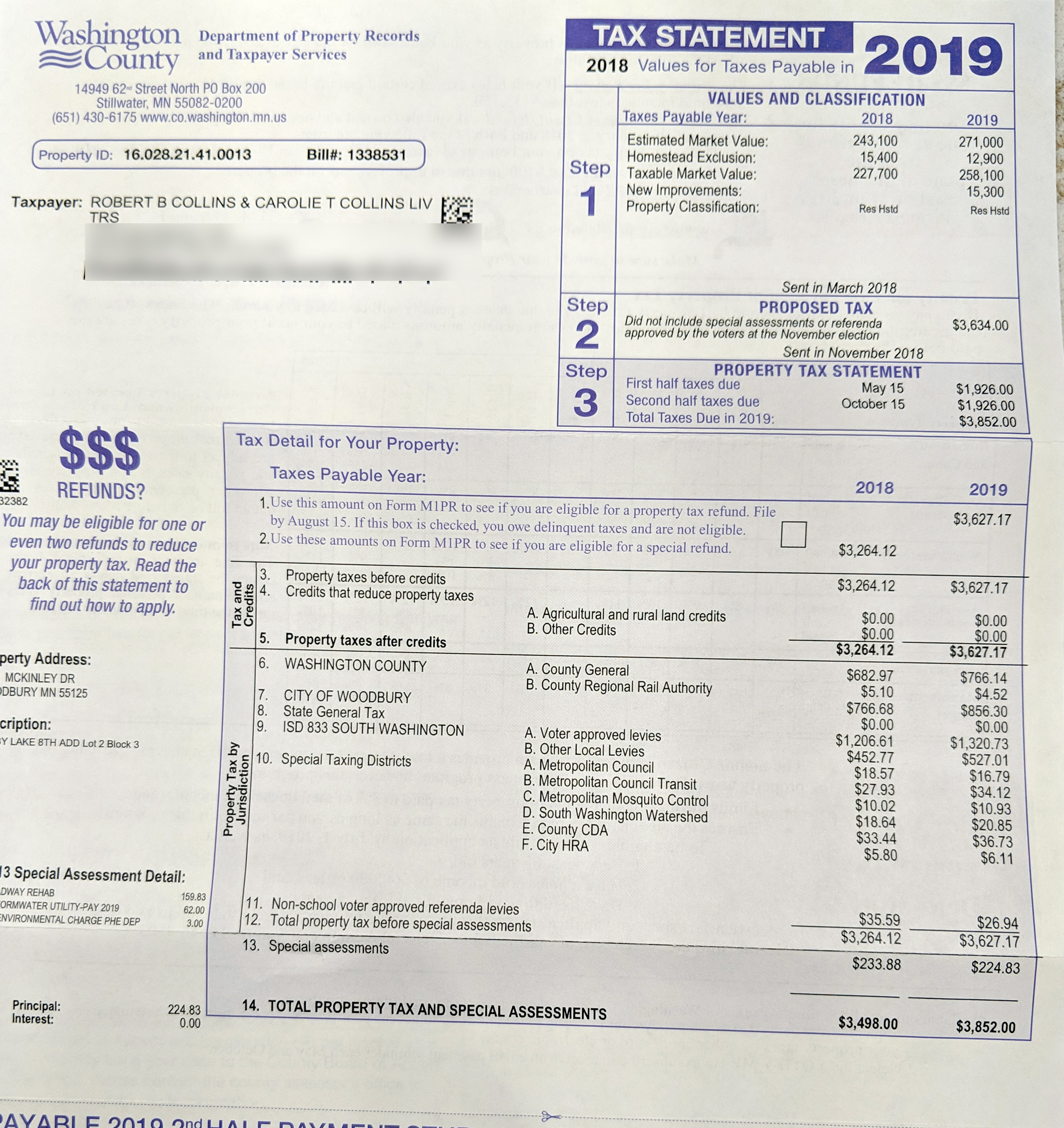

There was a big jump in market value (maybe because we had a kitchen redone) and the taxable market value wasn’t reduced as much as last year because of a reduction in the “homestead market value exclusion,” and if you know how that is calculated year to year, there’s help for that.

Anyway, the bottom line in my neck of the woods is a 10 percent increase in property taxes, which is a little odd considering the only industry in Woodbury are cheap chain stores and housing permits and both are booming.

A 22 percent increase in the Met Council’s Transit assessment is interesting, given that Woodbury is the transit backwater it’s been since transit was cut significantly during the early days of the Pawlenty administration. There are promises that someday the Gold Line bus rapid transit, which because of Lake Elmo’s refusal to let it end in its community will only extend into Woodbury for about a half mile, will be built. But it’s a race right now between it and Armageddon.

We approved some school levies because out here we still believe that smart kids are better than stupid ones, and we made the mistake of spreading assessments for street repaving over 10 years or so, rather than just biting the bullet and writing a check for the street work. Like many communities, a third of the cost is paid for assessments on homeowners.

All in all, it’s a typical statement. Nobody likes paying taxes, but the quality of life and amenities are good, Washington County is unbeatable at plowing roads and providing parks, the schools are decent when they’re not hiring killers and perverts to ride the buses, and every few years or so you can meet the neighbors.

By the way, I turn 65 this year, so I should be eligible at some point for Minnesota’s senior citizen tax deferral program, in which the state lends you money to pay your taxes beyond 3 percent of your total household income. It’s better than losing your home, but this seems like a problematic situation when the state comes looking for its money when you die or sell. I’d be interested in hearing from people who’ve used the program.

Anyway, your turn. I’m interested in hearing from people whose taxable home values have dropped but whose taxes have gone up.