Terrance Sargent has struck out in his bid to get the Minnesota income tax declared unconstitutional.

The Minnesota Supreme Court didn’t even hold oral arguments in Sargent’s case against Minnesota’s revenue commissioner before upholding the tax on wages.

Sargent, of Waseca County, didn’t pay his income taxes in 2010, 2011, 2012, 2013, and 2014 and in 2016 the state put a lien on him.

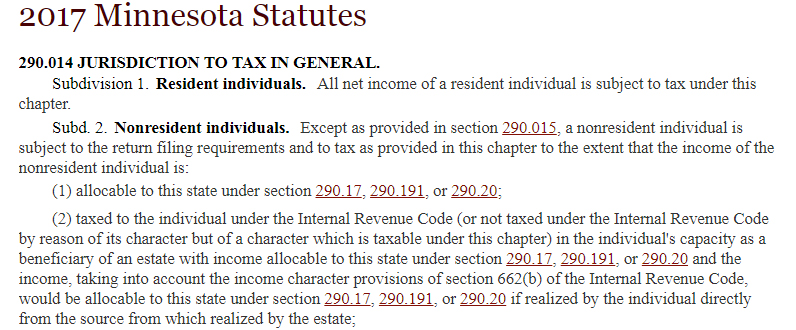

Sargent argued that there’s no law giving Minnesota the authority to tax people’s wages and that the tax violates his right to earn a living.

The arguments are without merit, Supreme Court Justice David Lillehaug declared, writing for the court in its decision.

“It is well settled that a state has the authority to tax income,” he said.

He’s right. It’s right there in words and everything.

“Sargent urges that a failed proposal by the Legislature in 1932 to amend the Minnesota Constitution to provide for an income tax is evidence that the tax is unconstitutional. This contention is meritless,” he said.

“It is elementary that the power of taxation is inherent in sovereignty and that under our system of government it reposes in the Legislature, except as it is limited by the state or the national Constitution,” he concluded.