Periodically through the various health care debates, someone inevitably talks about people getting free health care. Who are these people?

They’re not the people on Medicare, a new study says.

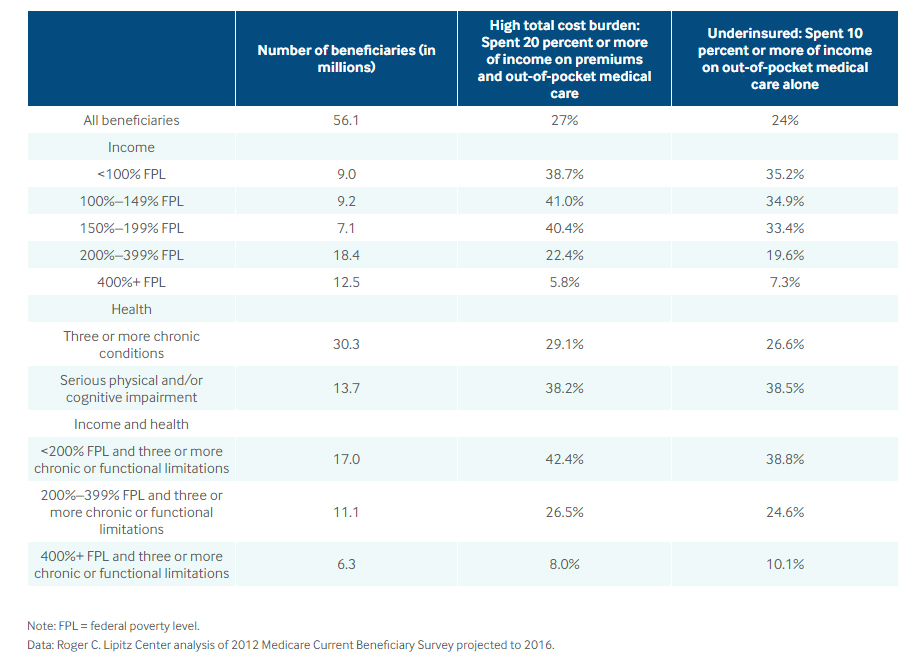

Fifty-six million people are currently enrolled in Medicare. Twenty-five million of them live below 200-percent of the poverty guideline, according to The Commonwealth Fund.

Some very poor people, if they can navigate the requirements, are eligible for full Medicaid ( Medicaid pays Medicare premiums and cost-sharing expenses and provides expanded benefits, including long-term care), but the new study shows that most are spending a large percentage of their annual budgets on premiums and out-of-pocket care.

Medicare beneficiaries spent an average of $3,024 per year on out-of-pocket costs. Of this, more than a third was spent on cost-sharing for medical and hospital care, 25 percent on prescription drugs, and 39 percent on services Medicare does not cover, including dental and long-term care, the study said.

People are are only on Medicare and have no supplemental coverage, spent an average of $5,374 on out-of-pocket costs in 2016.

And the report found that Medicare beneficiaries with serious cognitive impairments and/or serious physical impairments spent more than three times the amount of money out of pocket as other beneficiaries who do not have such disabilities: $5,519 annually vs. $1,549.

The survey said that although Medicare has been successful at controlling cost per enrollee, the aging baby boomer generation will make the program more expensive and put it “on the policy agenda.”