At least in the short term, a scolding from a politician can be costly, but it takes a lot more to bring a big bank down.

John Stumpf, the Pierz, Minn., native and the boss of Wells Fargo, appeared at a congressional hearing to explain how his employees — they’re called “team members” at the bank — engaged in fraudulent business practices, signing customers up for products they didn’t want.

“This is not good for our customers and that is not good for our business,” he said. “It’s against everything we stand for as a company. That said, I accept full responsibility for all unethical sales practices in our retail banking business, and I am fully committed to fixing this issue, strengthening our culture and taking the necessary actions to restore our company’s trust.”

That’s when Sen. Elizabeth Warren took over.

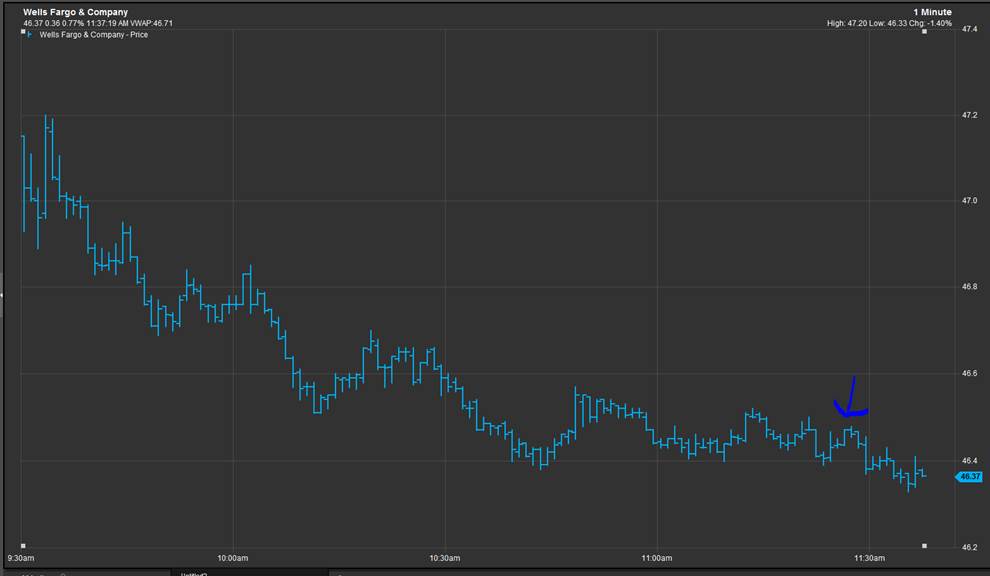

As Warren spoke, Wells Fargo’s stock price dropped.

But it was short term as investors figured the scandal, like most banking scandals, would blow over. And maybe it already has. The stock is up more than 1 percent in today’s trading.