If your health insurance comes as part of your employer’s benefits package, you’re probably pretty familiar with how much more expensive it is than it used to be.

It’s not just the premiums. Deductibles and co-pays have been rising faster than most employees’ wages’ ability to keep up.

In its 2015 employer health benefits survey released today, Kaiser Foundation found that while premiums increased an average of 4 percent, wages increased only 1.9 percent.

Employees contribute an average of 18 percent of the total premium for those with single coverage; 29 percent for those with family coverage. The bigger the firm, the higher the contribution by the employee.

Covered workers’ average dollar contribution to family coverage has increased 83 percent since 2005 and 24 percent since 2010, Kaiser reported.

But co-pays and deductibles are pushing costs even higher. It’s one thing to have insurance. It can be quite another to be able to use it.

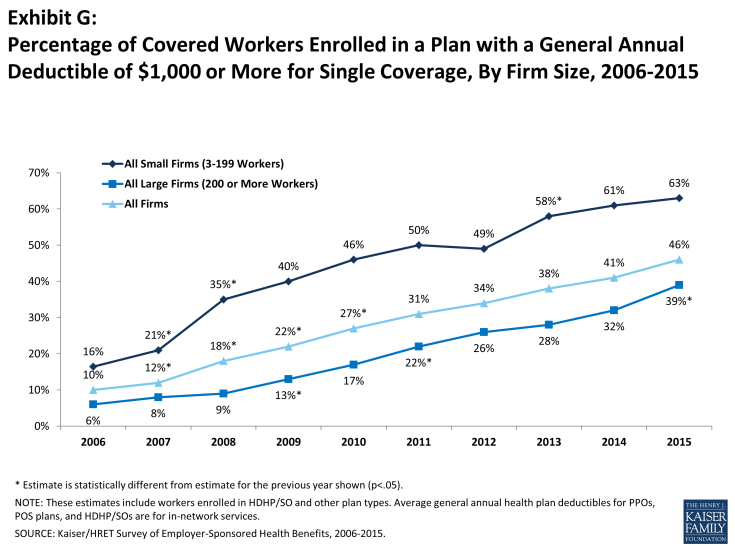

Looking at the increase in deductible amounts over time does not capture the full impact for workers because the share of covered workers in plans with a general annual deductible also has increased significantly, from 55% in 2006 to 70% in 2010 to 81% in 2015.

If we look at the change in deductible amounts for all covered workers (assigning a zero value to workers in plans with no deductible), we can look at the impact of both trends together. Using this approach, the average deductible for all covered workers in 2015 is $1,077, up 67% from $646 in 2010 and 255% from $303 in 2006.

A large majority of workers also have to pay a portion of the cost of physician office visits. Almost 68% of covered workers pay a copayment (a fixed dollar amount) for office visits with a primary care or specialist physician, in addition to any general annual deductible their plan may have.

Smaller shares of workers pay coinsurance (a percentage of the covered amount) for primary care office visits (23%) or specialty care visits (24%). For in-network office visits, covered workers with a copayment pay an average of $24 for primary care and $37 for specialty care. For covered workers with coinsurance, the average coinsurance for office visits is 18% for primary and 19% for specialty care.

While the survey collects information only on in-network cost sharing, it is generally understood that out-of-network cost sharing is higher.

What’s the upshot?

In its story on the survey today, the New York Times relays the case of a woman who has insurance, but is delaying using it. That’s not the way it’s supposed to work.

Some are making difficult choices about what care they can afford. About two years ago, Beth Landrum, a 52-year-old teacher, who is insured through her husband’s job as an engineer, saw the deductible on her family’s plan increase to $3,300 a year.

Ms. Landrum decided to delay having the M.R.I. her doctor recommends she get every three years. Ten years ago, she had a noncancerous brain tumor that required surgery and radiation. “My doctor’s really mad at me because I haven’t had the M.R.I.,” she said, but she and her husband say they need to save toward the cost.

She is particularly concerned because they could owe thousands of dollars in medical bills if something unexpected happened, like a hospital stay, because their current plan asks them to contribute much more toward the cost of care. “It’s really scary,” Ms. Landrum said.

According to the survey, of those people who deductible equals at least 5 percent of their income, 40 percent said they’ve decided not to go to the doctor when they thought they need to.