(There are comments attached to this post.)

This Sunday is the fifth anniversary of the day Lehman Brothers went belly up. There have been big fines for companies who engaged in the fraud that took down the economy in the last decade, but no convictions. In the subprime mortgage business, banks provided risky home loans that they wouldn’t have to guarantee when the borrowers defaulted. They made globs of money and the penalties have been relatively modest, as crime goes.

So is it at all surprising that the subprime mortgage business is making a comeback? These are different, though, Marketplace reports. Borrowers have to prove they have the income to afford the mortgage:

Those credit dings mean that borrowers pay a lot to get a loan from Citadel. Upfront fees can top $10,000. Interest rates start at about 8 percent. But Perl also requires a minimum down payment of 25 percent. So far Perl has raised $200 million to lend. He expects Citadel will have a lot of competition in the next year and a half. “What you are going to find is instead of a $200 million marketplace today, this is going to be a several billion dollar marketplace,” Perl says.

Unlike 2006, when anyone with a pulse could get a loan, there are restraints on the growth of the subprime industry. New regulations have tightened credit standards and that means a safer market than the one of the early 2000’s. But it also makes it harder for lower-income borrowers to get a mortgage.

The problem, Marketplace says, is the incentives that allowed financial companies’ CEO’s and managers to make money on loans that were destined to fail are still not regulated well.

“To be blunt, I don’t think we want to have a housing market or a mortgage market that favors middle-aged, white rich people. We’d like a market that’s more diverse that reflects the population,” says Guy Cecala, the publisher of Inside Mortgage Finance. Which means there’s still the lure of offering sound-too-good deals to people who can’t afford the big picture.

Meanwhile, the Center for Public Integrity this week is presenting a three-part series on what’s happened since the banking market collapsed. Its findings:

* The SEC chairman who botched the job of monitoring the system now makes his money in business, helping banks and other companies navigate the new regulatory landscape that the crisis spawned. Most of the other people involved in the disaster, are living well.

* The subprime lending execs who were the architects of the collapse are back in business.

* The ex-Wall Street chieftains are living large in post-meltdown world.

“Wall Street is rocking and rolling, again,” a CBS reporter opined this morning. “They got bailed out and they’re ready to go; $30,000 bottles of Dom Perignon are flying off the shelves.”

The good times are rolling again in the Hamptons, reports Bloomberg.

As for the little people, things aren’t getting any better. The Washington Post is reporting this week on a system in the District of Columbia in which the elderly and the poor are losing their homes over incorrect liens. One woman, a 95-year-old woman with Alzheimer’s, lost her home over a $44.79 tax bill. Predators swooped in to grab the home at auction.

“I feel terrible,” said the woman’s nephew. “You pay your taxes. You do the right thing. You’re entitled to honest government that puts you first.”

Related: A local credit union takes a financial hit, but does the right thing anyway.

Some of us think we’re a little bit better because we’re a little bit better off. At the Cub in Edina recently, Sue Bulger paid for her groceries with an EBT card, to the disdain of the person behind her in the checkout line, she writes in a Star Tribune op-ed.

If I’d had the guts to talk with you, I would have told you about my disabled 28-year-old son living with us. We have never asked for public support for him.

But recently we have decided that it is our responsibility to introduce him to the programs that will have to support him when we are no longer here to care for him. We started small: He is eligible for food support, and he agreed to receive it to be able to feel that he is contributing his share to the food bill, since he is unable to work.

I know we looked like people you might think need EBT: a bit unkempt in sweatpants and T-shirts. If I’d had the guts to talk to you, I would have told you that I’d just had an emergency surgery and that my daughter came home from college five hours away to help for the weekend because my husband had scheduled surgery two days after mine. I haven’t been able to put on real clothes yet, and I can’t lift a bag of groceries.

I thought I could handle your disdain, since I am a professional working at a local corporation where I am surrounded every day by people who respect me and care about me. But it still made me feel a little dirty — unworthy — and I still went home and cried in the privacy of my shower so my family would not know I was hurt by you.

3) THE KIDS WHO GRIND AND THE KIDS WHO DON’T

The kids in Fargo are above average when it comes to dancing — or not dancing in this case. The Fargo Forum reports that while kids in Grand Forks walked out over a ban on “grinding” dances, students in the Fargo area are apparently more compliant.

The schools have even offered dance lessons to teach alternative, cleaner dances.

“We’re just starting, so it’s kind of slow, but the students showing up are having fun, learning how to dance instead of just freewheeling it out there,” the principal of a Catholic school said.

At Red River High School in Grand Forks, the principal invoked a “face to face with space” policy at school dances.

The kids, at the dance after the first football game, ignored the warning. When the dance was stopped by school officials several times for warnings, 150-200 kids walked out and moved the dance to a local park, where they grinded — ground? — to their heart’s delight.

Orval Amdahl, 94, of Lanesboro took a sword from Nagasaki, Japan when he was there in World War II. “At first, I kept it as a souvenir,” he tells the Rochester Post Bulletin. “Then, all of a sudden, I began thinking — someone had to own this.”

He has a conscience and tried to find whose sword it was so he could return it. But he had no luck with the effort.

Then, an author interviewing him for a book on the dropping of the atomic bombs volunteered to help and found Tadahiro Motomura, the grandson of the officer who once owned it.

Next week, the two will meet in the Japanese garden at Como Park in Saint Paul (Nagasaki’s sister city) and the sword will be returned.

“I want to get it back to the rightful owner … I won’t miss it,” Amdahl said. “I believe in peace.”

Related: When a Massachusetts history teacher stumbled onto the papers of a deceased local war veteran, he assigned his students to write the mystery man’s biography. What they found was Boston’s version of Forrest Gump. (h/t: Andrew Shipe)

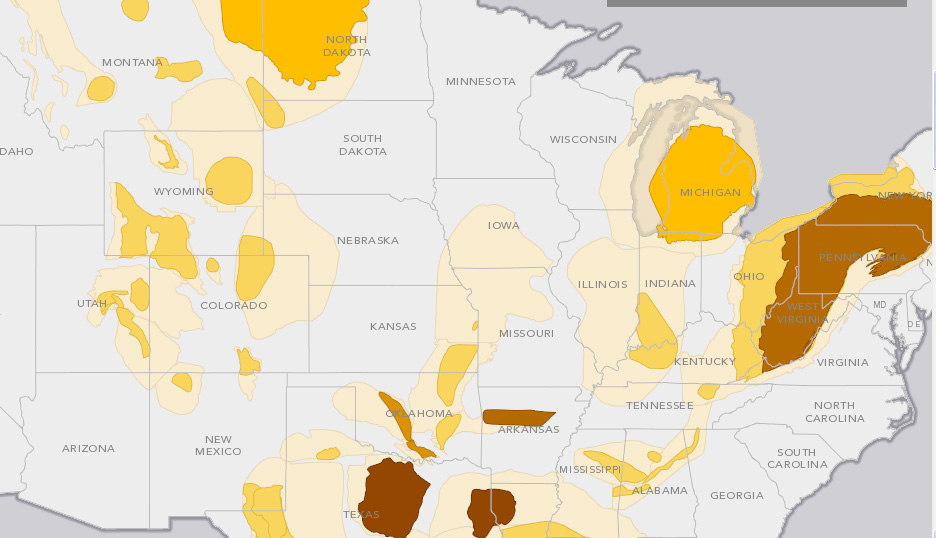

Smithsonian Magazine has created an interactive map showing the areas where fracking — the controversial method of extracting oil and natural gas — could soon be or is already underway. It’s mapped “plays,” places where the shale could yield oil and gas. It notes, however, that only a handful of “plays” are yielding anything at the moment.

Bonus I: A major fire has broken out in Winona’s downtown. The Winona Daily News has some photographs and details.

Bonus II: Twin Cities Business – Sports Radio’s Grand Slam. The format is coming to dominate Twin Cities’ local radio. But is it about profitability, market share, or prestige? (Twin Cities Business)

WHAT WE’RE DOING

Daily Circuit (9-12 p.m.) – First hour: This week on the Friday Roundtable, we’ll get three different perspectives on the coming transformation in health insurance and medical care. What are the challenges that remain as we get closer to the major provisions of the Affordable Care Act going into effect?

Second hour: Minnesota physician Wael Khouli on the Syrian medical crisis. Plus: BBC documentary on electronic cigarettes.

Third hour: Minnesota Orchestra management and a representative of the musicians discuss the sticking points remaining in their longstanding dispute.

MPR News Presents (12-1 pm): Journalist T.R. Reid on health care here and in other countries, and musicians Susan Mazer and Dallas Smith on music for healing. They spoke at the opening session of the Mayo Clinic’s “Transform 2013” symposium.

The Takeaway (1-2 p.m.) – A government shutdown is looming again.

All Things Considered (3-6:30 p.m.) – The 9th annual city deer hunt begins in Duluth tomorrow, when hundreds of bowhunters will take to the city’s parks, forest and even backyards to cull the deer herd. Urban deer hunts have spread throughout Minnesota and the country in recent years, as an affordable way to control the animal’s booming population. Groups like the Humane Society oppose the hunts, but in Duluth, it’s proven popular with homeowners tired of deer munching on their landscaping. MPR’s Dan Kraker will have the story.

Gathering data from a hurricane requires long hours of flying through the storm with sensitive instruments. Manned aircraft have limitations that drones don’t. They can allow scientists more than 24 hours to explore a weather system. NPR looks at using drones for non-military purposes later.