When last we left Vicki Hugen of Eden Prairie, she was trying to convince the bank that services the mortgage on her home to modify the mortgage. Wells Fargo had initially agreed to about a $2,000 a month mortgage, so she accepted her ex-husband’s offer to take his share of the house in lieu of alimony. Then, the bank dropped her from the loan modification program and offered her a monthly payment over $3,000, which she couldn’t afford. (Find the whole story here)

Things haven’t changed much since I wrote about it last fall. The Minnesota attorney general’s office said there wasn’t much they could do other than send a letter to the bank suggesting it do something. The bank hasn’t changed its offer, and thousands of dollars in late fees and penalties are piling up.

“I really don’t have much of a plan now,” she told me today. “Now I’m just getting random offers (from the bank). Each one starts out, ‘this is to confirm the modification we discussed.’ But I haven’t talked to anyone. ”

She says if her mortgage can be modified (she says she can afford about $2,300 a month), the fees and penalties would be removed, she could put the house on the market, sell it, and much of her mortgage could be paid off and she could “get out.”

“I thought I was taking a reasonable settlement after the divorce. I’d like to be able to sell the house and end up not owing them 30 grand (in fees,” she said. Filing bankruptcy is an option.

Hugen’s story, of course, is being repeated thousands and thousands of times all over the United States. These aren’t the old days when one could sit down with the banker who owns the mortgage. In Hugen’s case, Bank of America actually owns her mortgage. Or does it?

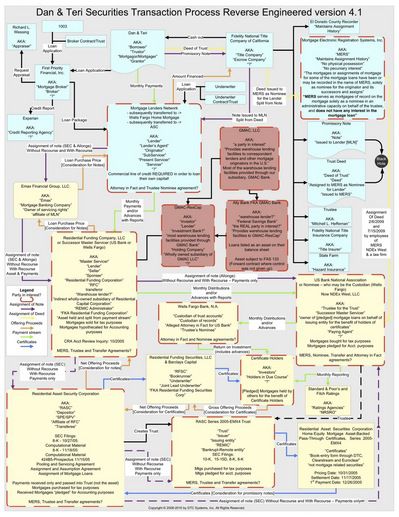

Consider this chart, which popped up online in November when a homeowner “reverse engineered” who owned the mortgage:

Somewhere in there, something may make sense.