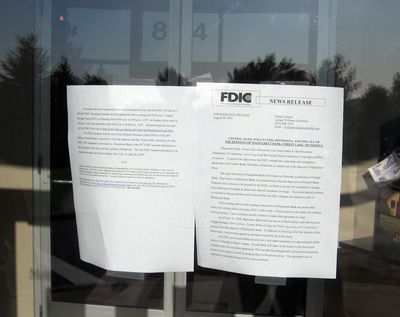

At the Mainstreet Bank branch in Woodbury on Saturday morning, it was a far cry from the scene in It’s A Wonderful Life when depositors stage a run on the Bailey Savings and Loan. The FDIC took over the failing bank on Friday night and sold it to Central Bank of Stillwater.

But there was a hint of slight tension.It didn’t take more than a couple of seconds of photographing the FDIC notice on the bank’s front door, before Central Bank President Scott Faust emerged — a Minnesota State Patrol trooper watching from just inside the lobby. He said it’ll be a few days before the Mainstreet Bank signage is wiped away, and the bank will open only a half-hour late on Saturday morning. Good news, perhaps, for a couple of people sitting in their cars in the parking lot waiting for the bank to open.

“But I shouldn’t be talking,” Faust said as he handed me the phone number for the bank’s CEO, Larry Albert.

Here’s what the notice on the door said:

*Central Bank, Stillwater, Minnesota, Assumes All of the Deposits of Mainstreet Bank, Forest Lake, Minnesota*

*FOR IMMEDIATE RELEASE

Mainstreet Bank, Forest Lake, Minnesota, was closed today by the Minnesota Department of Commerce, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Central Bank, Stillwater, Minnesota, to assume all of the deposits of Mainstreet Bank.

The eight branches of Mainstreet Bank will reopen on Saturday as branches of Central Bank. Depositors of Mainstreet Bank will automatically become depositors of Central Bank. Deposits will continue to be insured by the FDIC, so there is no need for customers to change their banking relationship to retain their deposit insurance coverage. Customers should continue to use their existing branches until Central Bank can fully integrate the deposit records of Mainstreet Bank.

This evening and over the weekend, depositors of Mainstreet Bank can access their money by writing checks or using ATM or debit cards. Checks drawn on the bank will continue to be processed. Loan customers should continue to make their payments as usual.

As of June 30, 2009, Mainstreet Bank had total assets of $459 million and total deposits of approximately $434 million. Central Bank will pay the FDIC a premium of 0.10 percent to assume all of the deposits of Mainstreet Bank. In addition to assuming all of the deposits of the failed bank, Central Bank agreed to purchase essentially all of the assets.

The FDIC and Central Bank entered into a loss-share transaction on approximately $268 million of Mainstreet Bank’s assets. Central Bank will share in the losses on the asset pools covered under the loss-share agreement. The loss-sharing arrangement is projected to maximize returns on the assets covered by keeping them in the private sector. The agreement also is expected to minimize disruptions for loan customers.

Customers who have questions about today’s transaction can call the FDIC toll-free at 1-800-405-7869. The phone number will be operational this evening until 9:00 p.m., Central Daylight Time (CDT); on Saturday from 9:00 a.m. to 6:00 p.m., CDT; on Sunday from noon to 6:00 p.m., CDT; and thereafter from 8:00 a.m. to 8:00 p.m., CDT. Interested parties can also visit the FDIC’s Web site at http://www.fdic.gov/bank/individual/failed/mainstreet-mn.html.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $95 million. Central Bank’s acquisition of all the deposits was the “least costly” resolution for the FDIC’s DIF compared to alternatives. Mainstreet Bank is the 83rd FDIC-insured institution to fail in the nation this year, and the second in Minnesota. The last FDIC-insured institution to be closed in the state was Horizon Bank, Pine City, on June 26, 2009.

# # #

Congress created the Federal Deposit Insurance Corporation in 1933 to restore public confidence in the nation’s banking system. The FDIC insures deposits at the nation’s 8,195 banks and savings associations and it promotes the safety and soundness of these institutions by identifying, monitoring and addressing risks to which they are exposed. The FDIC receives no federal tax dollars – insured financial institutions fund its operations.

Friday night is close-a-bank-night at the FDIC. Banks were also closed last night in California and Maryland. Eight-four have failed this year, mostly because of rising defaults on loans.

Hundreds more are expected to fail in the next few years largely because of souring loans for commercial real estate, the Associated Press reported.

The insurance fund has been so depleted by the epidemic of collapsing financial institutions that some analysts have warned it could sink into the red by the end of this year, the AP said.