State tax officials hope more people will take advantage of free filing

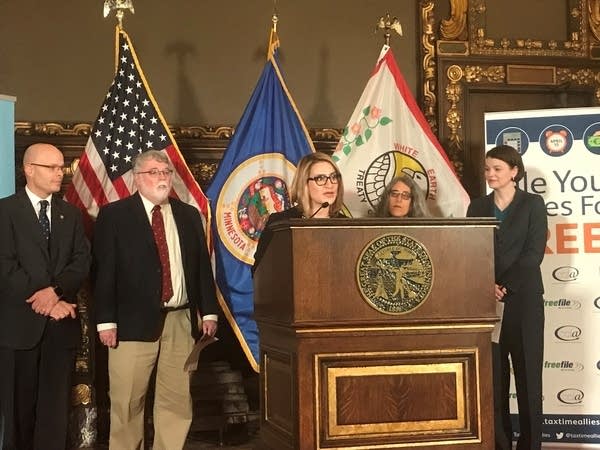

Some 800,000 Minnesotans likely eligible for free tax filing did not take advantage of it last year, Revenue Commissioner Cynthia Bauerly said Thursday.

Eligibility for different programs varies, but military members and those who make $66,000 a year or less are among those eligible for free electronic filing services for both their federal and state tax returns, she said. About 65 percent of Minnesotans are eligible for free filing, Bauerly said.

Create a More Connected Minnesota

MPR News is your trusted resource for the news you need. With your support, MPR News brings accessible, courageous journalism and authentic conversation to everyone - free of paywalls and barriers. Your gift makes a difference.

"We wanted to make a really big push this year to make sure people knew and were able to take advantage of those free opportunities that have existed all along but that people didn't know about," she said.

In addition, Bauerly said, more than 200 sites across the state offer free tax preparation help to seniors and other eligible taxpayers from IRS-certified volunteers.

Sen. Ann Rest, DFL-New Hope, and ranking member on the Senate tax committee, said the programs ensure those eligible for refunds and credits are getting them.

"When those families are benefited, we're all benefited, because the dollars they get from the working family credit and from the rent credit or the property tax relief credit goes back into their communities," Rest said.

Individual tax filers who itemized deductions in the past will likely still do so for their state returns, Bauerly said, though that might change for their federal return because of recent changes in federal tax law.

Changes to state tax law to conform with some of the federal changes could come up later in the legislative session. Lt. Gov. Peggy Flanagan said her and Gov. Tim Walz's proposal for changes to Minnesota taxes will be released Feb. 19.