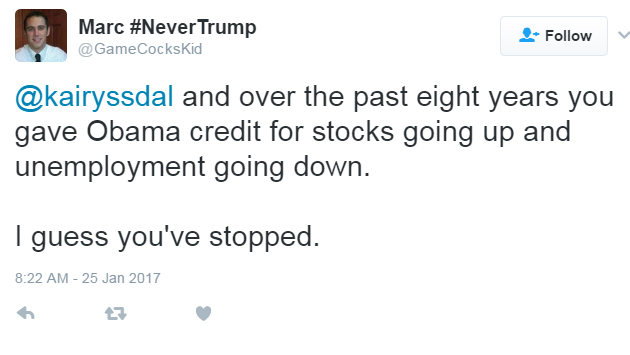

The Kai Ryssdal you hear on Marketplace isn’t the same Kai Ryssdal you read on Twitter, even though they’re the same person.

Radio ethics requires a less feisty, more dispassionate dispensing of facts. Twitter? Not so much.

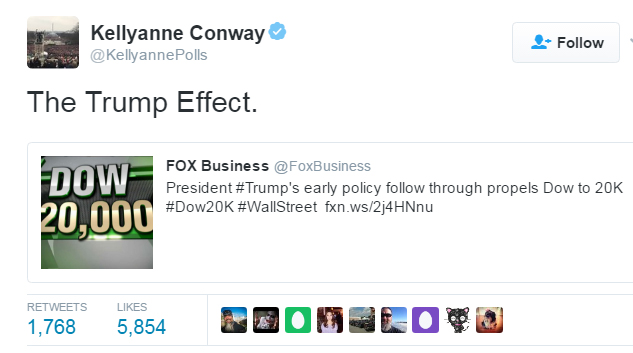

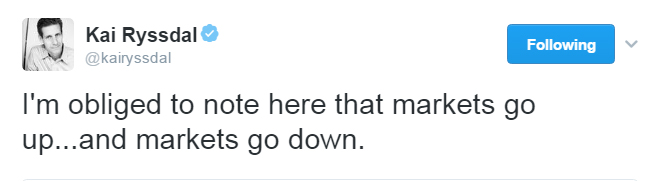

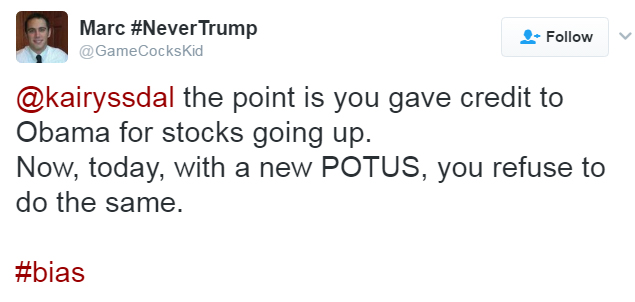

We can debate which is the preferred persona for a journalist/anchor, but Ryssdal’s Twitter response to the celebrants when the Dow went over 20,000 today was classic economics-meets-politics.

The silliness of all of this, of course, is that the stock market is a long-term play. That’s why people who left their money in the market during the economic collapse ended up making more money than those who pulled it out, even though those who pulled it out made more money in the short term.

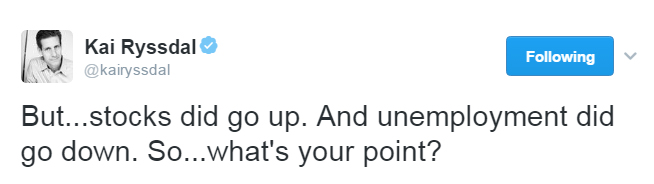

For the record, the Dow closed at 9625 on the day President Obama was elected, and 8077 after his inauguration. That’s a 16 percent drop.

At the close of his presidency, however, the Dow stood at 19,827. That’s a more than 18% per year increase.

On Election Day last November, the Dow closed at 18,868. Today’s 20,000 barrier represents a 6 percent increase.

Anyone who actually knows the market knows that past performance is no indication of future results. Obama’s 16 percent drop in value over the same period of time as Trump’s 6 percent increase only tells us one thing: Markets go up and markets go down.

But up is still better than down.