The Great Recession took a massive toll on the U.S. economy. Collapsing home values and lost jobs delivered a gut punch to many here and across the country. Debts and misery seemed to pile up.

Yet despite those woes, the majority of Minnesotans stayed current on their credit payments, even during the worst of the recession.

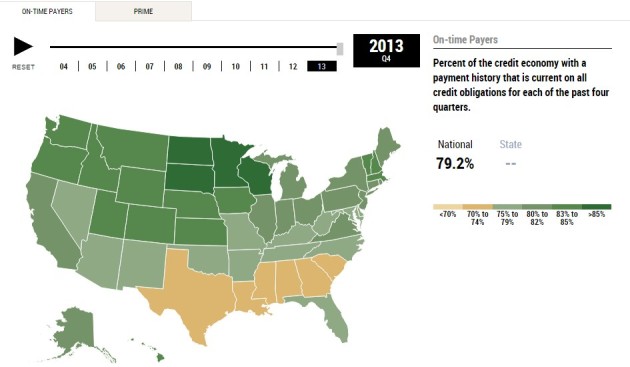

Data collected and mapped by the Federal Reserve Bank of New York show some fascinating patterns. In 2013, the most recent numbers available, 85 percent of Minnesotans with debt were current on payments of all kinds. In the counties with data, Otter Tail was the champ, with 89 percent current.

Even in the depths of the recession, the data indicate 83 percent in Minnesota paying on time.

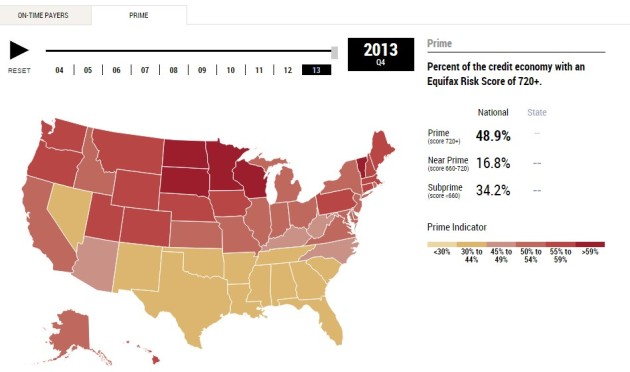

Given that diligence, it makes sense that the data on credit scores show Minnesotans among the best in the country in 2013, with nearly 60 percent considered a prime risk, far better than the nation as a whole:

Yes, it’s not just Minnesota.

We’ve had lots of fun over the years poking Wisconsin for its lackluster economic recovery compared to ours. But the New York Fed data show that Wisconsin and the Dakotas also have some of the best credit scores in the country — and do better than most of the U.S. in paying on time.

The data don’t explain why. But there’s no doubt that Upper Midwest economies survived the Great Recession better than other regions. Jobs came back faster here and when people have jobs, they generally make good on their debts.