Some people are going to want to sit down for this.

Minnesota has one of the least regressive tax structures in the country, according to the Institute on Taxation and Economic Policy, which has released a study of individual state’s tax policies to determine whether middle- and lower-income residents are shouldering more of the burden.

For the record, Minnesota’s tax system isn’t fair. But neither is any other state’s, according to the research.

When including all local tax burdens, 10 states stand out as localities that tax the bottom 20 percent of residents at rates that are up to seven times higher than the wealthy. ITEP singled out Washington state as the worst offender, with the poorest fifth of taxpayers paying 16.8 percent of their income in local taxes. The top 1 percent of filers paid 2.4 percent of their income in local taxes.

Washington and three other states in this group of 10 lack a personal income tax. As a result, these states often rely on higher sales and excise taxes, which take a larger burden of income from low- and middle-class families because they aren’t adjusted for income. Everyone, regardless of their wealth, pays a 6.5 percent sales tax in Washington.

South Dakota is also in the “terrible 10” along with Florida, Texas, Illinois, Pennsylvania, Tennessee, Arizona, Kansas and Indiana.

“The vast majority of states allow their very best-off residents to pay much lower effective tax rates than their middle- and low-income families must pay — so when the richest taxpayers grow even richer, these exploding incomes hardly make a ripple in state tax collections,” the authors of the research wrote. “And when the same states see incomes stagnate or even decline at the bottom of the income distribution it has a palpable, devastating effect on state revenue.”

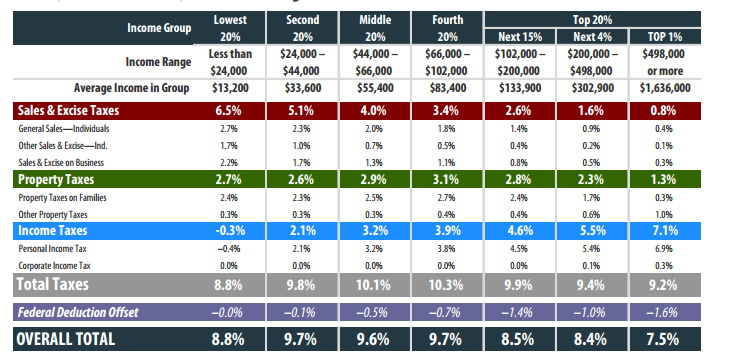

Minnesota, on the other hand, ranks 45th in tax unfairness, mostly because it has a graduated income tax, has a property tax credit, and the sales tax excludes groceries. It gets dinged, however, for having a high cigarette tax and a high sales tax. That, as you may have word, could get worse if another increase in the metro-area sales tax is authorized as part of a transportation funding solution.

According to the group, which describes itself as non-partisan, Minnesotans with adjusted incomes above $500,000 pay the least percentage of state taxes.

Other states besides Minnesota singled out for progressive tax structures are Delaware, Washington, D.C., Montana, Oregon and Vermont.