The Great Recession cost us a lot — lost jobs, collapsing home values and staggering debt we could no longer afford.

Data published today, though, show just how much was lost and, on a household basis, it’s stunning: American households on average have recovered only 45 percent of their wealth, adjusted for inflation.

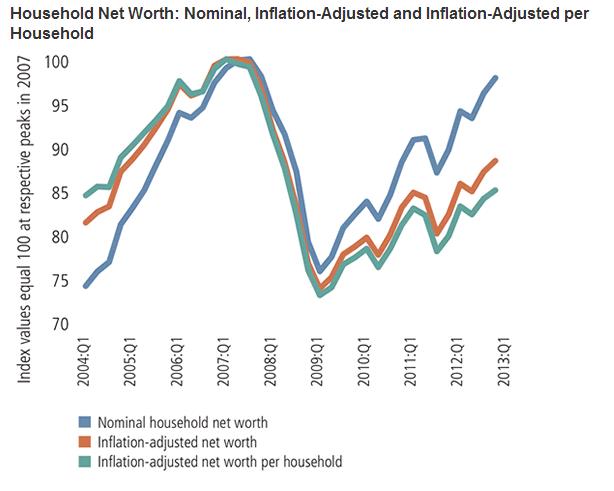

Here’s the chart from the Federal Reserve Bank of St. Louis:

It’s a fascinating graph. If you looked only at dollars (nominal), the net worth recovery looks great — 91 percent recovered. Frame the data by household and account for inflation and it really changes the view.

The Fed acknowledges:

Clearly, the 91 percent recovery of wealth losses portrayed by the aggregate nominal measure paints a different picture than the 45 percent recovery of wealth losses indicated by the average inflation-adjusted household measure.

Considering the uneven recovery of wealth across households, a conclusion that the financial damage of the crisis and recession largely has been repaired is not justified.

There’s no doubt the recovery’s been uneven.

The Fed data, for instance, show 62 percent of the overall wealth recovery has come from higher stock values. But in a cruel twist, Americans have been bailing out of the stock market the past few years while things have been hot.

Only about half the nation’s adults own stock now, according to the Gallup Poll, its lowest level since 1998.

June marks four years since the Great Recession ended and the economic recovery technically began. Most Americans households are still trying to recover.

Read the whole essay, appropriately titled, “After the Fall.” It’s a staggering, data-driven look at how a culture of diminished savings and debt leverage tied to home values collapsed when values dropped, recession came and people lost the jobs that held it all together.