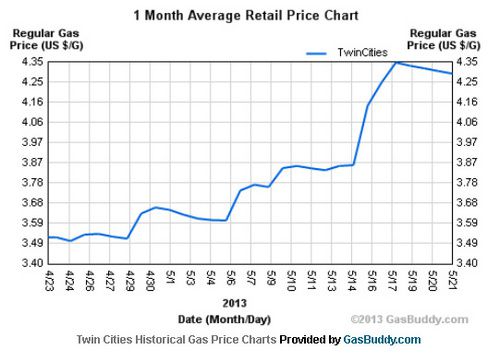

Gas prices are heading down in the Twin Cities after last week’s record high, but this chart shows a pattern we’ve heard about before. They don’t seem to be going down as fast as they went up.

What’s going on here? Slate looked at this question some years ago and found that the problem is you: When prices start to fall, you don’t shop around much as when they’re increasing.

A busy gas retailer will take delivery on a daily basis, so there’s some pressure to pass along price hikes without too much delay. The stations can’t raise prices too much, though, because consumers tend to be extra-vigilant about shopping for bargains when oil prices are on the rise. When the newspapers start reporting upwardly mobile barrel prices, drivers tend to comparison shop down to the penny. This keeps gas prices from rocketing even further.

The asymmetry that economists cite comes into play as soon as oil prices start to deflate. Freed from the constant reminders about rising fuel costs, drivers become less invested in looking for a bargain–and retailers don’t have to worry as much about the competition. As a result, station owners can keep drivers happy by knocking just a few cents off the “old” price.

The theory came from Matt Lewis, an economist at Ohio State University.

A key element of his theory is something economists call a “reference price.” Your local car salesman might know it as “framing.” Once consumers get a number in their head — $10,000 for that car, $3.70 for that gallon of gas — all subsequent choices are impacted by a new price’s relation to that reference price. When the car dealer says, “OK, $9,500,” you think you have a good deal. When the nearest gas station drops the price to $3.63, the average consumer impulsively stops searching.

“If prices are falling, you pull into a station and think ‘I have a good deal,'” Lewis said.

Daily Finance adds, however, that there’s another factor: There’s money to be made if you run a gas station. (h/t: Ken Paulman)

Here’s a simplified version of what happens (excluding taxes and the cost of environmental regulations that also affect gas prices): Say you’re a gas station owner who buys 10,000 gallons of regular unleaded gasoline — a month’s worth — at Wednesday’s wholesale price of $2.85 per gallon. Your bill comes to $28,500.

Imagine that you sell 9,000 gallons over the next three weeks, but then the price of oil drops, bringing the wholesale price for gas down 10 cents to $2.75 per gallon. You’ll be able to buy your next 10,000 gallons at the lower price and cut your pump price by 10 cents per gallon as a result, but if you reduce your prices right away, you wouldn’t cover the cost of the remaining 1,000 gallons of gasoline that you already bought at the higher price. Most likely, you’d wait until you’d sold those 1,000 gallons before cutting your price.