First some housekeeping: Over the years, NewsCut has earned a well-deserved reputation for intelligent and valuable insight provided by those who offer their comments. I don’t think it’s much of a stretch to say this is unlike a large number of online sites that are polluted by trolls and people who have little to offer.

Of late, many comments have very little to do with the subject matter of the post. While I seldom delete comments (I have a great blog management system that filters out the cheap handbag knockoff spam), I’m being more aggressive eliminating comments that don’t provide value to other readers. These include comments from people using phony email addresses, or single-line comments that only lightly reference the post. As always, comments that belittle other commenters are immediately deleted.

Most of the time, I send an e-mail to those people to explain why their comments were deleted. Most of the time, the messages bounce back from phony e-mail addresses.

At the same time, there are thousands of NewsCut readers each week who are reluctant to comment. Trust me: Your perspective is valuable and will be protected here. The wide diversity of talent and experiences gives us an opportunity to consider viewpoints we might not previously have considered (a comment in the previous post is a perfect example). On those occasions, we are all well served by your participation.

We will not be discussing this in the comments section today. But there are plenty of other things to note.

1) TEAR PARTY

If you went to bed early last night you missed a 278-million-to-one occasion (according to Nate Silver): The Red Sox did not make the playoffs when they blew a sure win, seconds before the Devil Rays turned around what had appeared to be a sure loss (Thanks primarily to Coon Rapids’ Dan Johnson).

“The most magical night in baseball history,” MLB Network declared. Wait! More magical than a 10-inning shutout that won a World Series? Keep in mind this was for the right to be the worst team in the playoffs, not win a World Series. It’s a bad idea to write history seconds after it occurs.

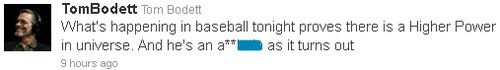

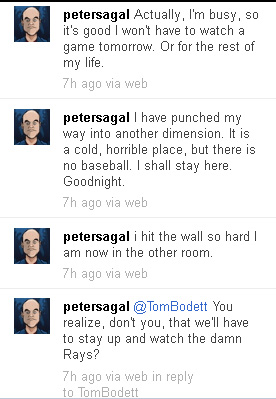

Still, it was way more fun than the second half of a Vikings game:

Peter Sagal’s “Wait! Wait! Don’t Tell Me!” might not be that funny this week:

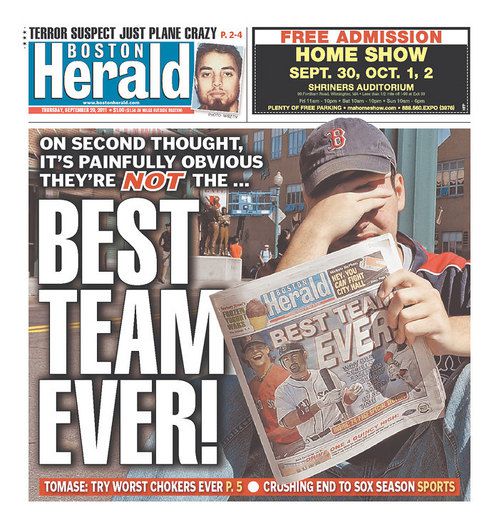

The best front page in America today belongs to the Boston Herald, which pulled out its own front page from earlier in the season…

NPR says baseball fans were left hyperventilating…

A tale of two cities: The Twins, meanwhile, won an exciting contest that had the players rolling on the field congratulating each other because it meant they didn’t lose 100 games. Exciting stuff, indeed.

One last takeaway from the “magical night”: There’s no moment sweeter than a little kid singing “Take Me Out To The Ballgame.”

2) SHOULD STUDENT DEBT BE FORGIVEN?

Students are coming out of college with a stunning debt load. How’s this for an idea: Forgive it. Some students at the University of Minnesota are signing a national petition asking the federal government to wipe out the debt, figuring students could stimulate the economy by spending money they otherwise would be spending on paying their loads, the Minnesota Daily reports.

“That’d be a lot of money that our economy could use,” says Alexis Reineke, who graduated from the University of Minnesota in December 2008 with a communications degree and

$35,000 in debt. She makes enough now to pay about $260 month on her loans.

The idea comes from Robert Applebaum, who started the petition, and has posted it on the We The People site at the White House:

Forgiving student loan debt would provide an immediate jolt to the economy by putting hundreds and, in some cases, thousands of extra dollars into the hands of people who WILL spend it – not just once, but each and every month thereafter – freeing them up to invest, buy homes, start businesses and families. This past year, total student loan debt finally surpassed total credit card debt in America, and is on track to exceed $1 TRILLION within the next year. Student loans themselves are responsible for tuition rates that have soared by 439% since 1982 and for saddling entire generations of educated Americans with intractable levels of student loan debt from which there is, seemingly, no escape. Relieve them of this burden and the middle class WILL rebuild this economy from the bottom-up!

Caution: Old person story ahead. When I graduated from college in 1976 with my $4,000 in debt (that’s about $16,000 in today’s dollars), the last thing the financial aid boss said was, “make sure you pay this money back, because it’ll be used to lend to other students later.”

3) GOVERNMENT AND THE BOOZE BUSINESS

State governments need you to drink more, the New York Times says today. It needs the cash alcohol generates. Dozens of states have changed alcohol laws to try to gin up more revenue — from raising alcohol taxes to allowing drinking on Sundays.

“These are kind of antitax times, so it’s tough to raise any kind of tax, but this is one they might have more success with,” said Mark Stehr, an associate professor of economics at Drexel University in Philadelphia who has studied the effects of taxes and other regulations on cigarettes and alcohol.

Lakeville officials have received a study to help them determine whether the municipal liquor stores make money and whether the city should get out of the booze-selling business. They do and it won’t.

4) DO YOU KNOW THE PUMPKIN MAN?

You can always spot the kid who’s going to grow up to be successful. In Fargo, Kain Carlson has figured out an unfilled niche. There weren’t enough door-to-door pumpkin salesmen in town. There weren’t any. Now there’s Kain Carlson, pumpkin man.

He’s pocketed about $1,000 so far, WDAY reports, and given a chunk of it to a Moorhead homeless shelter.

5) RACE-E-BOY

We have a new record for world’s fastest couch. The record was set on Monday in Sydney.

Bonus: A bridge to the arts…

(h/t: Bryan Reynolds)

TODAY’S QUESTION

Australia has announced that women will soon be able to serve in combat with the infantry, in the special forces and in other front-line positions. Today’s Question: Should the United States start allowing women to serve in all combat roles?

WHAT WE’RE DOING

Midmorning (9-11 a.m.) – First hour: A new book by Pulitzer Prize-winning journalist Ron Suskind describes rivalries and dysfunction within President Obama’s first economic team.

Second hour: In her new book, physicist Lisa Randall examines the role of risk, creativity, and uncertainty in scientific thinking, and why answering the biggest scientific questions we face could tell us who we are and where we come from.

Midday (11 a.m. – 1 p.m.) – First hour: Rep. John Kline.

Second hour: Live broadcast from the National Press Club featuring entrepreneur Elon Musk, speaking about private sector space travel, electric cars, and the digital future

Talk of the Nation (1-3 p.m.) – First hour: a preview of the upcoming Supreme Court term.

Second hour: Stories from a Chicago cabbie.