The Congressional Budget Office — as in the non-partisan Congressional Budget Office — threw cold water on the notion that President Obama’s proposed budget is going to do anything to lower the budget deficit. One reason? Lower taxes.

Here’s what the CBO has to say:

Of the various initiatives that the President is proposing, tax provisions would have by far the largest budgetary impact. The 2010 tax act (officially the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010, Public Law 111-312) extended through December 2012 many of the tax reductions originally enacted in the Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA) and the Jobs and Growth Tax Relief Reconciliation Act of 2003 (JGTRRA). The President proposes to extend those reductions permanently, with some modifications, and to permanently index for inflation the amounts of income exempt from the alternative minimum tax (AMT), starting at their 2011 levels. In addition, the President proposes that, beginning in January 2013, estate and gift taxes return permanently to the rates and exemption levels that were in effect in calendar year 2009. Those policies would reduce tax revenues and boost outlays for refundable tax credits by a total of more than $3.0 trillion over the next decade relative to the amounts projected in CBO’s baseline. That total exceeds the $2.7 trillion net increase in the deficit over the next 10 years that would result from the President’s budget as a whole; the President’s other proposals would reduce the deficit, on balance, over 10 years.

Theoretically, the tax cuts would boost economic activity to make up for their cost to the Treasury. That doesn’t appear to be the prediction.

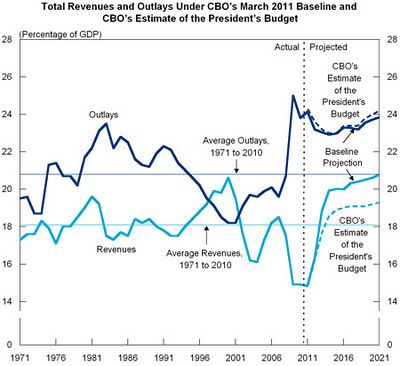

Both sides, of course, will point to the other side in this debate to indicate who’s causing this reality. But it’s this chart, supplied by the CBO, that shows the fallacy of just about every campaign speech ever given on the subject.