At last night’s DFL gubernatorial debate, House Speaker Margaret Anderson Kelliher tried to pin former Sen. Mark Dayton on his plan to “tax the wealthy” by saying a Minnesota cop married to a Minnesota nurse would be subject to Dayton’s tax increase plan.

Dayton countered by saying the couple would not be, because the average police officer’s salary is $51,000 and the average nurse makes $73,000, for a combined $124,000, below Dayton’s threshold for a tax hit.

Let’s play with the numbers. The key to Dayton’s rebuttal is both “average” and “salary.” While the average may be $51,000, that doesn’t mean there aren’t cops who make more than that. And the average salary is just that: Salary, not including overtime, which is often the bread-and-butter for cops.

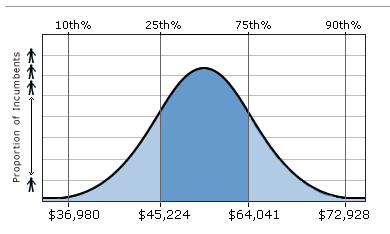

Salary.com’s “Salary Wizard” for Minneapolis patrol officers shows the entire spectrum for base pay.

Look at the Pioneer Press’ database of salaries for public employees. There are lots of police officers — many from St. Paul — making $70,000 in “base pay” with another 10 percent tacked on for overtime.

A similar database from the Star Tribune showed a police sergeant in Minneapolis made a base salary of $77,000 in 2007, but had a total salary of $105,000 once the overtime was factored in.

Are there cops making much less than that? Sure. But Dayton issued a blanket dismissal of the assertion based on statistical averages, not “real life.”

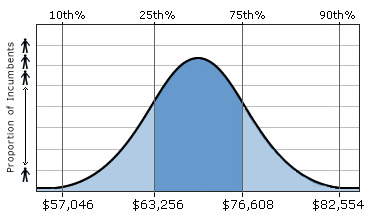

What about the nurse spouse? Salary.com shows the base pay for a Twin Cities RN is about $70,000, but the upper 25 percent at that level makes around $76,000.

In a 2009 report, the Bureau of Labor Statistics said the mean annual salary for a registered nurse in Minnesota is $72,760, with the upper level at about $97,000 a year. That doesn’t include any overtime.

Dayton’s tax plan dings couples making $150,000 a year, although that’s believed to be the benchmark after deductions.

Could the mythical cop and nurse couple be paying a tax increase under the Dayton plan? Sure. But based on the salary statistics and the expectation of a sliding scale of increased taxes under his still-unformed plan, probably not much more.

Whether that couple of “rich,” is a matter of debate.

And, of course, Dayton’s opponents have not issued a blanket “no new taxes” guarantee for this couple, either.