Good news/bad news in a study on household debt from the New York Federal Reserve Bank today:

For the first time since early 2006, the share of total household debt in some stage of delinquency declined, from 11.9 percent to 11.2 percent. However, the number of people with a new bankruptcy noted on their credit reports rose 34 percent during the second quarter, considerably higher than the 20 percent increase typical of the second quarter in recent years.

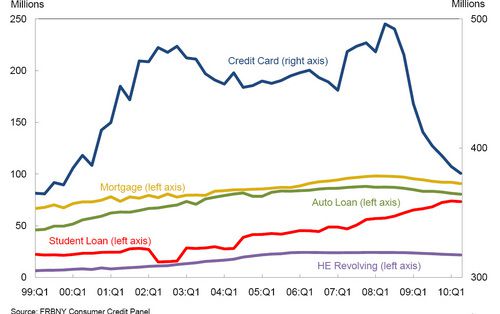

How are people cutting their debt? Check out this graph from the bank’s report. This indicates the number of accounts by the type of account. Blue indicates credit cards.

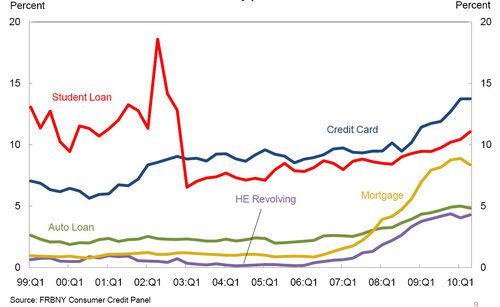

But as a percentage of the balance of delinquent loans, credit card debt has increased while student loans have taken a big drop.

The report also charted the loan delinquency situation in several of the hardest-hit states. Minnesota wasn’t one of them. You can find the full report here.

Is this consistent with your household finances? Are you total loans dropping, increasing, or staying the same over the last year?