The Dow dropped 500 points at the open today, dropping below the 8,000 mark for the first time since March 31, 2003. There are some interesting views being expressed today and I’ll be dropping them in here. An analyst on CNBC suggested before the open that “we hit bottom today.” Maybe it’s wishful thinking, or maybe it’s actual optimism, something we’re simply not used to.

8:42 a.m. Bob Andres, of Portfolio Management Consultants, says what’s happening is “irrational pessimism.” He called for “a timeout,” and suggests there be a few days of “bank holidays.” He also wrote earlier this week in the Washington Times, “The financial landscape will be remarkably different, and we suspect so too will the social landscape” after the historic events of the past month.

8:49 a.m. – It’s a rally! The financial sector is up. Is this it? Is this the end of the slide? The Dow is back above 8,000. The credit markets are, we’re told, “beginning to thaw.” President Bush to make a statement shortly.

9:03 a.m. – Blame Game O Rama. BusinessWeek has a good story on the earlier warnings sounded by two state attorneys general (no, ours wasn’t one of them) to a Congress not willing to believe them.

9:05 a.m. – Opinion piece: Forget about tax cuts. (Dow has stabilized with about a 200 point drop.)

9:11 a.m. – A cheer goes up on the floor of the New York Stock Exchange. It sounds like the Metrodome when Tavaris Jackson is pulled from the game. The Dow goes positive.

9:13 a.m. – The Dow drops again. “This place sounds like a stadium where a team is losing by 40 points and the backup quarterback is put into the game,” CNBC’s anchor says. Hey, get your own material, fella!

9:20 a.m. – At 2:30 this afternoon, officials from the Minnesota Department of Finance and Employee Relationswill discuss the state’s quarterly economic update. It’ll be interesting to see if there are sales tax receipt updates from August and September, one way we can determine whether the Republican National Convention helped or hurt the local economy.

9:25 a.m. Dow is down -83.95. President Bush just started speaking. He says the “United States government is acting and will continue to act.” He says banks holding mortgages have suffered serious losses and American businesses have not been able to finance expansion.

“Anxiety can feed anxiety and that can make it hard to see all that is being done to solve the problem,” the president said. “We can solve this crisis and we will.” He highlights the steps the government has been taking over the last few days.

He says the commercial paper market has been freezing up. (Explainer: What is commercial paper and why does it matter?) The president says it will take time for the bailout to work.

He didn’t take questions.

9:33 a.m. -186.06 The Dow dropped 100 points while President Bush was speaking.

9:35 a.m. – Here’s an interesting story worth chewing on. In the Washington Post (reg. required), The End of American Capitalism?

“People around the world once admired us for our economy, and we told them if you wanted to be like us, here’s what you have to do — hand over power to the market,” said Joseph Stiglitz, the Nobel Prize-winning economist at Columbia University. “The point now is that no one has respect for that kind of model anymore given this crisis. And of course it raises questions about our credibility. Everyone feels they are suffering now because of us.”

9:39 a.m. – Time Magazine: Charities are bracing for a long, hard winter. I beat you by four days, Time. (Dow now down 290)

9:46 a.m. – A very good comment in the comments area that I’m hearing more and more. Essentially, if the media would just shut up and report good news, these problems would go away. Discuss.

10:02 a.m. Wall St. Journal: Ten ways to protect your finances from the crisis. One controversial item:

6. Stop pulling a Monty Python when it comes to your worst investments. If you ever saw John Cleese and Michael Palin perform their famous skit about the dead parrot, you know exactly what I mean. No, your Fannie Mae shares aren’t “resting.” They’re lying at the bottom of the cage with their feet in the air. What more do you need to know? So stop waiting for them to “recover” before sorting out your portfolio.

These days all of my investments are my “worst investments.”

10:13 a.m. – As of today, average gasoline prices in the Twin Cities are just 17 cents higher than a year ago. 18 cents statewide. The price has gone down another 4 cents in the last 24 hours.

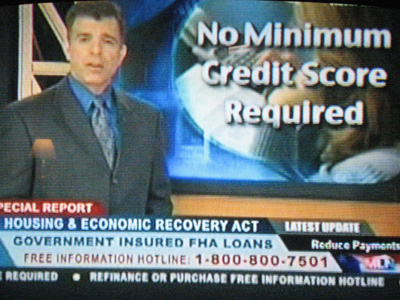

10:43 a.m. Dow down 343. Maybe you’ve seen ads on TV like this:

What’s this? Refinancing? Without regard to credit scores. Isn’t that what got us into this mess in the first place? What’s going on here.

This company — Lend America — is actually trying to buy up mortgages and convert them into FHA loans. According to the Long Island Business Journal, the firm is bucking the trend by buying adjustable rate loans — usually at a loss to the investor. The warning flag is that the FHA requires a credit score of 580. The advertisement says people can refinance “up to 97 1/2 percent of the home’s value,” but many adjustable rate mortgage holders have mortgages that are now more than the value of the home.

Obviously, look carefully here. But FHA loans are still available to potential homebuyers. In addition to the credit score requirement and you need a 3 percent downpayment.

11:57 a.m. – In a few minutes, MPR’s Midday will take a look at the volatility of the markets. Guests are: Louis Johnston: Economics professor, St. John’s University and the College of St. Benedict; Ross Levin: Founding Principal of Accredited Investors Inc. and author of “The Wealth Management Index.” He is a regular columnist for the Journal of Financial Planning and the Star Tribune. The Dow is down 312.

12:12 p.m. – Johnston says there’s no sign of the credit crunch easing. Levin says this is temporary. Here’s a quote you won’t like: “The pain will be great and the bleeding will be extensive.”

12:19 p.m. – The two guests discussed the Wall Street Journal article today (I provided a link earlier) that said this isn’t a short-term deal. Neither bought the notion although one pointed out that, technially, the market has been down for 9 years.

Questions:

Q: Where is the money that people have lost?

A: Unlike a hat or unlike a pair of socks, this money “evaporated.” It didn’t really go anywhere.

Q: Should I plow a lot of money into stocks now while things are at bargain-basement levels.

A: Probably yes but not for the reason you think. The caller was 24. The percentage of what he’d invest is a small amount of “total future compensation.”

Q: Why not give everyone a pile of money rather than give it to the banks?

A: The $700 billion actually works out to around $400 and we saw what happened when we sent stimulus checks to everyone.

Q: If all the banks failed, what happens to my mortgage?

A: Good question. If it ends up in bankruptcy court, who collects the money from the mortgagee’s? It could take a long time to work out. There’d be nobody to provide loans or do any inter-company transfers. People with mortgages would be in legal limbo.

Q: Why should I have to bail out people who overextended themselves?

A: Resist the urge for vengeance; it will only make matters worse.

Q: is the media providing good information or fanning the flames of fear?

A: We constantly reporting what’s happening with the Dow . We need a patient discussion that goes through the problem and says “here’s what’s wrong and here’s what we need to do.” It’s far too much breathlessness.

Q: What should we do with the 401K statements that are arriving this week?

A: Put them in the shredder.

1:40 p.m. – Dow down 484. Looking for optimism? Try a spoonful of The Big Picture, which uses plenty of charts I don’t understand to come to a conclusion I can.

1:43 p.m. – Here’s the full MPR/Humphrey Institute survey that shows the economic crisis is reshaping the political agenda, just weeks before the election.

2:57 p.m. – This economy must have several feet because shoes keep dropping. Finance & Commerce reports today that pensioners of three state-managed plans are getting pretty squeezed.

3:09 p.m. The “every problem is an opportunity” award today goes to Barb DeGroot, PR specialist for the Minnesota Arboretum who just sent a press release out:

Stock market crashes, nasty political ads….the world is too much with us these days. Poet William Wordsworth’s refrain aptly describes the current mood in the United States. I invite to you come to the Minnesota Landscape Arboretum and experience “Autumn Unplugged,” a celebration of the colors and quiet beauty of fall. Please see attached release for weekend events and a color report We are nearing peak color, by the way! Thanks and have a great weekend.

That’s a pro right there.

And as long as we’re on the subject, here’s a photograph reader Kelly Rice sent me that he took while walking his daughter to school in Oakdale yesterday.

OK, now back to the economy…

3:14 p.m. Dow closes with its best showing of the week. It lost only 126 65 points.

3:18 p.m. – We’re on a tidal wave of unbridled optimism. The state took in more money than expected last quarter. The sales tax revenue was down. We need to see that broken out by city to determine if the RNC did any good, economically. The bad news: The economic outlook has worsened, which I guess isn’t really news at all.