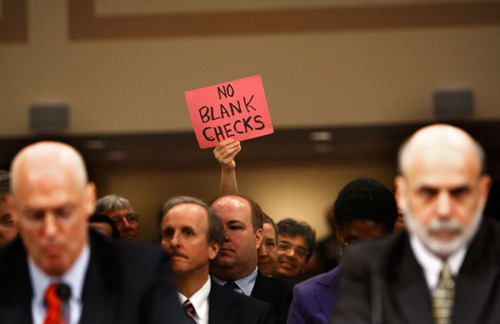

“Let them fail!” As people get a more in-depth look at the (at least) $700 billion bailout of the nation’s biggest financial institutions, it’s a cry that is growing in volume. Today, the government bosses who were responsible for getting ahead of the financial crisis — and clearly didn’t — went to Capitol Hill to sell the plan to increasingly skeptical politicians, who also were in office while the crisis grew.

“Rage Sweeps over Middle America,” the Times of London blared today.

Richard from Anchorage, Alaska, was typical of many when he wrote on CNNMoney.com: “NO NO NO. Not just no, but HELL NO.”

Anna from Denver wrote on the same site at the weekend: “This is robbery pure and simple.” Claudio from Plainville, Connecticut, added: “It’s our money! Let these companies die.”

It’s settled, then. Let them die rather than pass along the cost of keeping them on life support, which — by the way — is $5,354 per taxpayer, and still — depending on who you believe — may not work.

The dialog around the issue this week is very much like the one that surrounds the war in Iraq. It doesn’t matter anymore how we got there. We’re there. Now what are our choices?

What does “let them fail” look like on Main Street?

“Jobs will be lost, … our credit rate will rise, more houses will be foreclosed upon, GDP will contract, … the economy will just not be able to recover in a normal, healthy way,” Federal Reserve Chairman Ben Bernanke said today.

Megan McArdle, writing on The Atlantic’s Web site, suggests the damage isn’t limited to the fat cats and stupid consumers. She says companies — like yours, perhaps — that used credit sparingly, will go from a short-term bad economy, to a long-term bad economy.

The problem is, the effects of really rapid contractions don’t last a couple of months. They last years. Can your company withstand the bankruptcy of some major clients with large outstanding accounts? How many people will it have to fire if its order book drops 40%? Can it cover its fixed expenses even on half staff?

I talked this afternoon to Gary Krueger, the head of the Economics Department at Macalester College about how “let ’em fail” would impact you and me. “You’d drastically reduce the size of the financial sector. There’d be a panic. A good chunk of our savings is foreign. They’d be less willing to lend in the future, they’d stampede out of the dollar-dominating (financial) instruments, he said.”

So?

“You wouldn’t be able to get a mortgage, the value of a dollar will drop, the price of oil and gasoline will go up,” he said. Russia in the ’90s provides the best example of an economy without a functioning credit market. “It wasn’t pretty. People lived hand to mouth,” he said.

Student loans? Forget ’em under “let ’em fail,” according to Krueger. “If you had to pay for things hand-to-mouth, you could afford to take one class a year every year and 32 years later, you’d have your degree. Or you could use the credit markets to graduate in four years and begin taking advantage of it,” he said.

Another option, he said, is one employed by Japan in the ’90s in which the government would occasionally intervene in the stock market, and make balance sheets look better than they really are. The economy didn’t grow for 15 years. “It’s slow water torture and the government creates fiscal stimulus with low-rate-of-return projects. I just talked to a friend who was in Tokyo and he says there are post offices in Japan the way Starbucks is here,” Krueger said.

Part of the reason for a “let ’em fail” recommendation by people in “Middle America” may be that financial calamity takes a couple of years to work its way to Main Street. The stock market collapsed in 1929 and the depth of the Great Depression was 1933. The savings-and-loan crisis hit around 1989, and America went into a recession in 1991.

No matter what “American savings has to increase and consumption has to fall,” says Krueger. The savings, however, will come involuntarily. You and I simply won’t be able to afford to spend money because the credit will be too tight to make us want to.

What does Krueger’s gut tell him? “In Bernanke I trust,” he said, even though he doubted the Fed chairman earlier this year when he lowered interest rates, a move which seems now to have been the right call. “He’s a student of financial crisis,” Krueger says.

The best advice for average people? Krueger says don’t hit “update” on your Quicken program. “Go buy an ice cream instead.”