I’ll try to live-blog during the day on Monday in this space, but suffice it to say Monday looks like a day of financial disaster in the U.S.

Lehman Brothers is expected to file for bankruptcy, Merrill Lynch looks like it’ll sell its sell-the-good-silver self to Bank of America and AIG and Washington Mutual are on death’s doorstep.

Earlier in the day on Sunday, the U.S. government said it would not guarantee that Lehman would be allowed to continue trading in the markets. End of Lehman. Workers were seen Sunday night carrying boxes out of the building. Their jobs will disappear too.

There’s still plenty of money on Wall Street, the Wall St. Journal notes, and as careers end and stocks slide on Monday, it notes that Wall Street bosses are lining up to make a killing.

Still, it seems like a long time ago when the the brewing financial crisis was simply blamed on a few homeowners who bit off more than they could chew.

7:07 a.m. – Oil down to about $95. Dow futures down 348.

7:11 a.m. – Jim Rogers of Rogers Holdings on Marketplace this morning:

You are going to see more financial failures. You’re going to see less credit. You’re going to see a contraction of the American and world economy. Again, many people, many of us are going to have more difficult times. Some of us are going to do extremely well, but there will not be many of those.

7:15 a.m. – Was Lehman solvent when it handed out more than $5 billion in bonuses in 2007? Good question asked by the blog Credit Slips.

7:18 a.m. — MPR’s Chris Farrell will be on with Morning Edition host Cathy Wurzer around 7:54. His theme: The government… won’t save everyone on Wall Street.

7:54 a.m. – Farrell sees the more stunning news being Merrill Lynch (“the broker to the working class”). The significance of the moment is the line in the sand the feds drew. “They needed to do that after the rescue of Freddie Mac and Fannie Mae.” What do investors do? “My primary advice is don’t do anything. I can spin out all kinds of scenarios. Most of the time when people make a dramatic move in their portfolio at a dramatic time like this, it’s usually the wrong thing. Most people have gone conservative on their portfolios.”

How bad can it get? “Really bad,” he says. “When does this end? It doesn’t appear that anything the authorities are doing can stop it. The long-term concern is economic growth. We’ve taken on way too much debt and the long-term trend is moving back from debt. But the economy breathes on debt.”

-

Audio not found

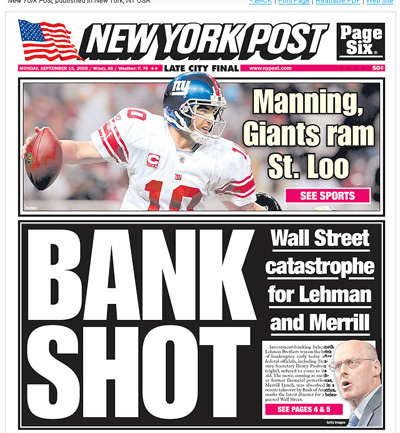

8:25 a.m. – The Silver Lining Dept. As long as Eli Manning is still the top story in the city that never sleeps, perhaps the Republic is safe:

8:37 a.m. – Dow down 103. That’s less than many thought, although it’s still early.

9:02 a.m. – So much for that. Dow down 337.

9:08 a.m. – Bank of America is having a news conference to talk about its buyout of Merrill Lynch. “Good strategic fit” and “absolutely no pressure from the government” are the key elements so far. See live archived video (CNBC).

10:38 a.m. – How does this turmoil play into the presidential race. The New York Times Caucus Blog notes Obama’s and McCain’s reaction today. Neither is in favor of federal bailouts.

11:07 a.m. – Updated time stamp on the post.

11:13 a.m. – Twin Cities’ mortgage expert Alex Stenback, who writes the Behind the Mortgage blog, says:

The immediate impact on main street will be lower mortgage rates, as money runs to the safe haven of (now Govt guaranteed!) mortgage bonds and other securities (treasuries also are rallying today) to wait out the storm

11:23 a.m. – Whoa! Huh? Wilbur Ross, chairman and CEO of WL Ross & Co. on CNBC says up to 1,000 banks may close.

12:20 p.m. – Worry? Don’t worry? I wish everyone would get on the same page.

Nouriel Roubini, of NYU’s Stern School and RGE Monitor, who notes there is already a “slow-motion run on retail banks” occurring nationwide.

That “run” could accelerate as people realize the FDIC fund has about $50 billion to “insure” about $1 trillion in assets at the nation’s financial institutions, says Roubini. “They’re going to run out of money” unless Congress acts soon to recapitalize the FDIC.

1:05 p.m.– From The Sky is Not Falling side of the fence, Andrew Ross Sorkin, writing on the New York Times’ DealBook blog:

Things are tough, but the economy is still in reasonable shape. All of these troubles at Lehman, Bear, A.I.G. and WaMu are attributable to the housing crisis. If we solve that, we will begin to emerge from the woods. While parts of the country are stabilizing, others appear caught in a declining feedback loop. It would help most if we found a floor on the housing decline. To the extent the government is the answer here, then this is where it should focus.

1:07 p.m. – The Dow is down 295 points. We’ve seen a lot worse on a lot better days. By the way, have you looked at Northwest Airlines stock lately? Even with energy prices and a poor economy, the share price is down only $1.22 from what it was when its merger with Delta was announced.

2:45 p.m.– How big of a deal is the financial meltdown? Maybe not that big of a deal in the big scheme of things, but in New York City there’s talk that it may push the city into a recession. Thirty-thousand jobs may be lost in this mess, the Boston Globe says.

2:46 p.m. – Economic worries will take the spotlight of Sarah Palin and put the issue back in play in the campaign, says the Washington Post.

3:00 p.m. – Dow Jones is tossing Lehman from the 30 Industrials. The Dow (with Lehman selling for 20 cents a share. A year ago it was near $60.) is down 493 points.

3:11 p.m. – Is one of your mutual funds listed here?

* Fidelity Select Brokerage & Investment, 4.4 percent of assets

* Morgan Stanley Financial Services, 3.2 percent

* Legg Mason Partners Aggressive Growth A, 3.2 percent

* API Efficient Frontier Value, 2.5 percent

* Tanaka Growth, 2.4 percent

Those are the funds with the biggest holdings in Lehman Bros. Many funds dumped the stock, but not before the price had dropped, CNN reports.

3:14 p.m. – Oddest question of the day comes in a Chicago Tribune Q&A in which guy asks if the bonds in his UBS brokerage account are safe. The bonds are General Motors.

3:17 p.m. – Wall Street has saved the worst for last. Dow down 505 points.

3:20 p.m. – What does this mean to you? “If you’re in the market for a loan to buy anything right now, the banks are not interested in you,” says Diane Garnick, investment strategist at Invesco. She says the economy may still be tanking halfway through the administration of the next president.

3:35 p.m. – The CEO of Lehman Bros., was paid $22.1 million last year. I’d have taken the company into bankruptcy for a fraction of that.

3:59 p.m. The final word today goes to the Motley Fool:

As painful as it is, as painful as it will be, the fact that both the government and the financial industry let Lehman fail is ultimately a sign of confidence in our financial markets.

Think about it — all of the players involved knew quite well that the markets would absolutely tank if they didn’t make a deal. And it wasn’t that capital was unavailable; despite the credit crisis, there’s plenty of capital out there to bid — from the more liquid Wall Street banks, from sovereign wealth funds, or from private equity players like Blackrock (NYSE: BLK) or Blackstone (NYSE: BX).

And yet these players found the risk of financial Armageddon more palatable than the price they’d have to pay to take over Lehman. There will be plenty of collateral damage with this bankruptcy — and they still decided not to act.