8:04 a.m. Richard Anderson of Delta and Doug Steenland, boss at Northwest, are holding a conference call for investors.

(Latest factoids are added at the bottom)

8:04 – Anderson: “With fuel prices what they are, the changes in the open skies area, we think it’s a really good fit. The balance sheets are in great shape. The route structures have been rationalized. Strong cash position with about $7 billion in liquidity.”

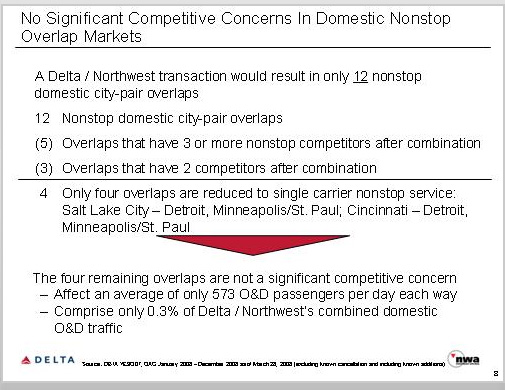

8:07 – Steenland: “Merger by addition.” He cites relatively little route overlap.

8:09 – Steenland: “Combining functions such as I.T.” There’s your first clue of whose jobs are in peril, I guess.

8:13 – Steenland tries to downplay anti-trust concerns. Here’s a graphic he used:

8:15 – Anderson: “No need for hub closures.”

8:19 – How long will this merger take. “We plan to achieve all synergies by 2012,” Anderson says.

>> $$$ Alert! NWA stock preopen price up $1.03 at $12.25. Delta opens up .27 at $10.25. The premium is now down to 56 cents based on Northwest stockholders getting 1.25 shares for every share of NWA stock owned. It was $1.88 based on the closing numbers yesterday. This number is changing quickly. See Delta stock details here. See NWA stock details here. AX a question!)

8:30 – Company anticipates more use of 100-seat airplanes. But that’s not good news for aircraft manufacturers. It’ll involve use of existing aircraft. Plans to use DC-9s more; that’s the plane Northwest had been trying to phase out.

8:38 – Both of Northwest and Delta coming up on “affinity card relationships.” “We’ll be in a position to maximize our position for our shareholders.” English translation: Between U.S. Bank (Northwest) and American Express (Delta), someone’s going to lose some money.

>> The best-laid plans alert!! — Oil just passed $113 a barrel — up $1.57. A new record high. >> Disappearing dollars alert!! NWA stock now down 72 cents to $10.50. Delta down almost a $1 a share. That’s what a runaway day in the oil market (now up almost $2 a barrel on the day) will do.