(This post was updated at 1:35 p.m.)

A lot of attention has been paid to the problem of student loans — and deservedly so. Kids today are coming out of school with tens of thousands of dollars of debt, and declining job prospects. And, as we learned today, this is particularly true in Minnesota where the cost of higher education is well above the national average.

But a study out today from St. Paul-based Securian Financial Group says the same problem is being faced on the other side of the working-years spectrum. More people are going into retirement in debt.

“If you start retirement in debt, the chance of you running out of money is higher,” said Mathew Greenwald, who conducted the survey.

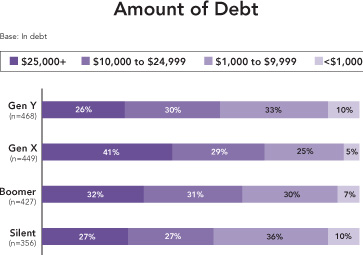

The survey, released this afternoon, says 26 percent of Baby Boomers and 33 percent of the Silent Generation expect to carry non-mortgage debt into retirement. Slightly more than half of current retirees reported they retired with such debts.

In many cases, according to the survey, consumers don’t even realize they are in debt. Nearly half — 46 percent — failed to classify “at least one common financial obligation such as outstanding balances on credit cards, home equity lines of credit or even overdue utility bills as debt. And 11 percent of people with debt don’t consider themselves being in debt.