One of the pillars of the economy may have a hangover headache already.

Target apparently got pushed around in holiday sales by long-time rival Wal-Mart, whose lunch the Minneapolis-based retailer has been eating for several years.

“There’s no doubt that Wal-Mart is back,” Craig Johnson, president of retail consultancy Customer Growth Partners, said to CNN.

Johnson, who has tracked the rivalry between the two discounters since the late 1990s, said Target has consistently drubbed Wal-Mart (WMT, Fortune 500) on same-store sales growth in November and December – a period that can account for nearly half of a retailer’s sales and profits – by enticing shoppers with glitzier ads, better-quality products and more name-brands.

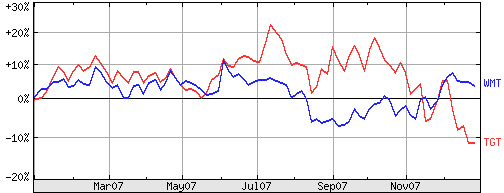

A look at the stock performance shows two companies heading in opposite directions at the moment. Wal-Mart is in blue. Target in red.

Even worse, according to the New York Post, one of Target’s largest shareholders is still restless.

There are even worries that, while Wal-Mart’s famously dowdy fashions are on the mend, Target staples like Isaac Mizrahi are growing stale after too many years on the racks.

That’s a problem for investors including activist shareholder Bill Ackman, whose hedge fund Pershing Square revealed this week that it now owns nearly 10 percent of Target.

While Ackman is rumored to be pushing Target to sell its credit-card receivables, the credit crunch appears to have put the idea on hold.

Target closed the day at $50 a share, well off of its $70.75 high in July, but not far from where it was a year ago ($54.72). Wal-Mart closed at $48.53, not far from its high in 2007 of $51.44, and ahead of where it was a year ago ($46.23).